Driving growth - Monetising 5G connected cars

In this article, we’ll take a quick spin through the exciting opportunities fuelling communication service providers’ interest in 5G connected cars. We'll also explain how mobile-optimised content delivery technologies will enable them to capitalise on emerging trends in the automotive sector.

The connected car opportunity

The automotive industry is undergoing a seismic shift – one that will unleash a multitude of new revenue producing opportunities for communications service providers (CSPs). Amid the rise of battery-powered vehicles and autonomous driving technology, advancements in wireless communications are expected to drive some of the biggest changes in the automotive market over the next decade. 5G, a global wireless standard that offers faster connection speeds, better response times, and the ability to connect many more devices to the network, is fundamentally changing the way vehicle manufacturers view their role in the world.

Rather than simply building vehicles that get people from place to place, car manufacturers are increasingly focused on how vehicles can connect passengers with the world around them, not just physically, but also digitally. By connecting people using advanced wireless technology, automakers seek to position themselves at the centre of a growing value chain that is being driven by personalised in-vehicle services. Given CSP’s central role in the build-out of 5G networks, the on-going transformation toward 5G connected cars will generate new opportunities for ambitious network operators to work in partnership with automotive companies interested in delivering immersive media, entertainment, and transportation experiences to their customers. CSPs are poised to drive real revenue growth by aligning themselves to the specific needs of these automakers.

The link between 5G investment and connected cars

According to the latest report from GSMA Intelligence, CSP’s will spend nearly $1 trillion on 5G network technology over the next five years. Already, more than 160 service providers have launched commercial 5G services, and 5G rollouts are expected to continue at a rapid pace through 2026. By that time, 5G connectivity will reach about 60% of the world’s population and the global 5G subscription base will account for roughly 40% of all mobile subscriptions (Ericsson). Even with a temporary dip in deployment momentum caused the COVID-19 pandemic, 5G investment is expected to bring about the fastest mobile technology upgrade in history.

Beyond boosting the performance of mobile handsets and tablets, 5G investment is expected to greatly expand the range of devices that can be connected to wireless networks. Internet of Things (IoT) devices, including smart batteries, home appliances, security cameras, home automation systems, and yes – connected cars – represent substantial growth opportunities for purveyors of 5G. As reported by Markets and Markets, a global research firm, the global 5G IoT market size will grow from USD $2.6 billion in 2021 to $40.2 billion by 2026, registering an astounding Compound Annual Growth Rate (CAGR) of 73.0% during the forecast period. If you dig a little deeper into these figures, it’s clear that connected cars are a big portion of this growth. In fact, according to Gartner, by 2023 the automotive industry will become the largest market opportunity for 5G IoT solutions, representing 53% of the overall 5G IoT endpoint opportunity in that year.

In summary, a substantial portion of the growth opportunity surrounding 5G will be driven by connected cars, which suggests CSPs need to be focusing on this market segment as they build out their networks. To quote Stephanie Baghdassarian, a senior research director at Gartner, “as the automotive industry will be the largest sector for IoT endpoints and 5G IoT use cases in the long term, we recommend that communication service providers that want to be relevant in the 5G IoT market put this industry at the forefront of their investments.”

Connected car opportunities for CSPs

With their powerful 5G networks and proven experience in scaling out highly reliable services, CSPs are well positioned to generate incremental revenue by partnering with automotive companies that are interested in offering unique services and capabilities within their connected car products. There are lots of potential applications, many of which require some level of advanced functionality to be implemented within the 5G network. Some opportunities include:

In-car entertainment

Streaming audio and video content into vehicles is an obvious first application for 5G connected cars. The average consumer spends as much as an hour every day in their car, often more, offering automakers a captive audience for delivering streaming video, music, podcasts, and even games. Using contextual information such as time, location, and trip destination, a more personalised viewing experience can be offered to consumers as they travel. For example, if passengers are heading on a long trip, movie content might be recommended on in-car viewing screens, whereas podcasts or video clips might be more appropriate for a quick jaunt to the local shopping mall.Autonomous vehicle applications

Driverless cars may seem far off in the future, but industry experts are saying that Level 4 fully autonomous vehicles will be available for purchase by the public in 2024. That’s just a few years away. For reference, the Society of Automotive Engineers (SAE) defines cars with Level 4 automation to be vehicles that “do not require any human interaction” and “may not have a steering wheel and pedals”. Looking over the horizon, the opportunity for in-car entertainment will grow exponentially as drivers are relegated to the role of passengers. As trust develops in the reliability of automated driving software, passengers can divert their attention toward online activities powered by 5G connectivity. With no need for the driver to look out the window to navigate, futuristic car designs suggest that window surfaces will convert themselves into TV screens to provide immersive and engaging entertainment experiences, including virtual reality and augmented reality content. Beyond entertainment, there are also opportunities associated with managing the data associated with autonomous cars. According to Intel, each driverless car on the road will generate more than 4TB of data per day. This data will need to be both captured from and delivered to vehicles in real-time via 5G connection points to provide the best experience to passengers.Over the air updates

Unlike cars of the past, the next generation of vehicles will be heavily software driven, with updates delivered over the air (OTA) via 5G connections. Auto manufacturers see incremental revenue opportunities in providing subscription-based services and features to automotive consumers beyond the point of the initial car sale. For example, consumers might download a new energy-saving driving mode to their vehicle during a long trip, upgrade their audio system to catch a particular event, or temporarily add seat warming during the winter months. These updates will generate new fees for automakers and their CSP partnersPersonalised advertising

Inserting personalised video and audio advertisements into vehicles is a great way for CSPs and automakers to generate new revenue. In addition to inserting ads into streamed content, ads can be highly contextual and may be inserted intermittently based on the circumstance. Ad opportunities might present themselves as people enter their vehicles, when they are sitting idle at a stoplight, or when using navigation services. Using location-based information, highly relevant ads can be inserted for localized businesses. For instance, if the car is running out of energy, a local charging station can be promoted. If it’s early in the morning, a promotion for a nearby coffee shop would be pertinent. The real-time data resident within the connected car can be highly useful to ad targeting, thereby increasing the value of the ad space and the revenue potential for operators.Ride-share opportunities

The connected car opportunity is also driven by the rising use of ride-sharing apps. The global ride sharing market is projected to grow at a CAGR of 16.6% during the forecast period, from an estimated USD 85.8 billion in 2021 to USD 185.1 billion by 2026. With new car pricing up 5% and used car pricing up 27% since a year ago, ride-sharing represents a viable and less expensive alternative to owning a car for many people around the world. Passengers in the back of an Uber, Lyft, or other transportation service are prime targets for in-car entertainment, advertising, and even e-commerce. 5G connections installed in these cars provide the means to deliver revenue generating services to consumers as they are transported to their destinations.

The role of mobile-optimised content delivery technology

Most of the 5G services mentioned in this article require a substantial amount of data to support. To support these in-vehicle activities and provide a premium consumer experience, 5G networks need to be responsive to requests, delivering content and data in real-time without interruptions. Content delivery networks, origin servers, ad insertion systems and middleware platforms all need to work together to deliver an ideal experience to consumers on the go. Fortunately, new mobile-optimised content delivery technology provides the means for CSPs to build out their networks to fulfill the unique application requirements for connected cars. Some examples of mobile-optimised content delivery technology include:

Mobile-optimised content delivery networks (CDNs)

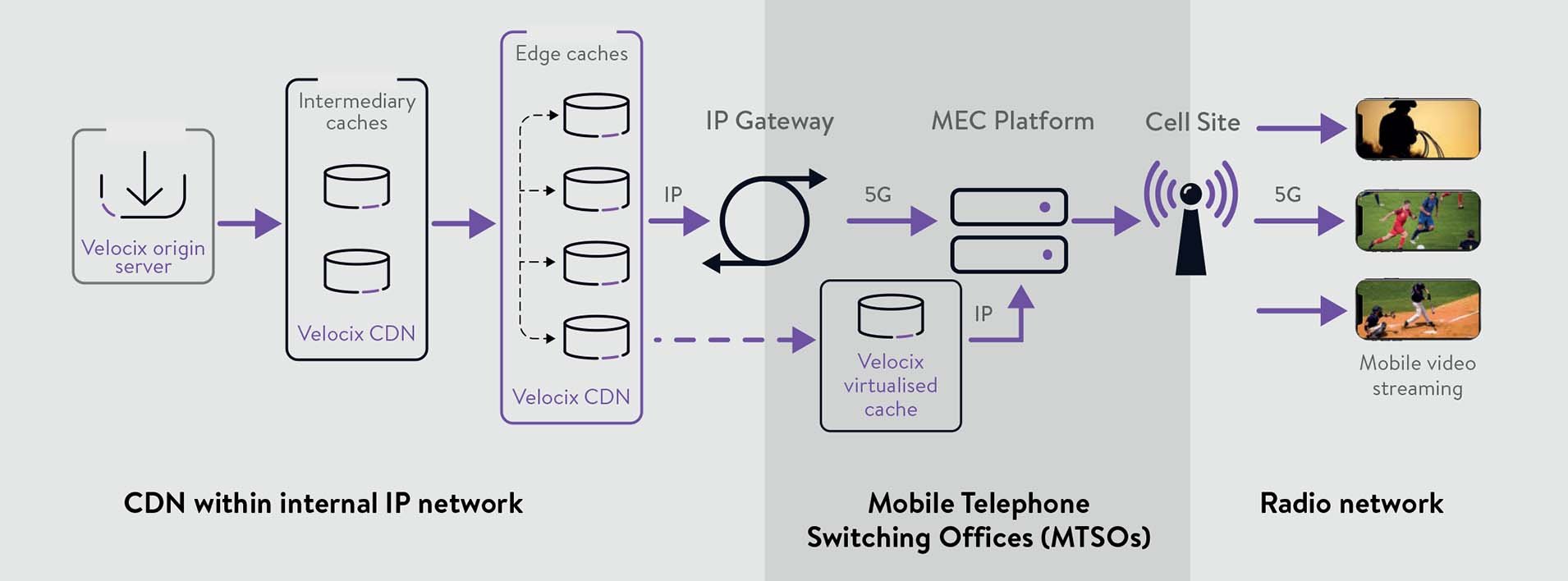

Mobile-optimised CDNs are similar to IP-CDNs used to efficiently deliver content to televisions and other connected devices over the internet, however, they include some special technology designed to ensure they perform optimally when serving connected devices over wireless networks. For example, mobile-optimised CDN caches are designed to run in specialised multi-tenant computing environments known as multi-access edge compute (MEC) platforms that are designed to run at the distant edge of CSP’s radio access networks. MEC platforms are placed close to subscribers at the perimeter of radio access networks to reduce communications latency, decrease upstream traffic, and deliver better service quality. MEC compatible caches are fully virtualized, so they can spin up capacity when needed and spin down capacity when demand drops. They also include application-specific edge request routing that is tailored to mobile-specific usage scenarios. For example, multi-tier routing logic can dynamically balance CDN traffic load between MEC caches and upstream caches in the IP core to optimise the use of the memory within MEC platforms and deliver the best efficiency across the entire network. Enhanced routing can also better manage service request from users that are traveling from one location to another, selecting the optimal cache in the CDN hierarchy and then adjusting delivery as needed to accommodate the consumer’s movement across geographies.

Stream personalisation

Manifest manipulation technology enables many of the personalisation features related to the connected car. For example:

- Server-side ad insertion

Context-aware server-side ad insertion (SSAI) technology can utilize data such as location, time, application, and device to match ad content with consumers more precisely in real-time. The ability to make better ad decisions drives more value for advertisers, which boosts ad revenues. - Bandwidth and other policy controls

Smart policy controls can be conditionally applied to content streams to protect consumers’ quality of experience while watching video over 5G networks. For example, if there are resource constraints on the 5G network, bandwidth controls can limit the available bitrate profiles for specific clients based on operator defined rules. Policy controls can also enforce content rights obligations related to viewing location, adapting to account for changes in the user’s location over time.

Recording and data capture

Content recording and storage capabilities offered in network-based origin servers can be used to capture and relay a wide range of data from 5G connected cars, including video camera data, telematics information, or live video recordings. Data may require specialised protection based on regulations and the nature of the data being stored. Mobile-optimised origin server technology implements the specific protections required and ensures data can be recalled instantly when needed.

In conclusion

In summary, CSPs are ideally positioned to generate growth as a result of the ongoing evolution toward 5G connected cars. With the right investment in mobile-optimised content delivery technology, they can deliver the captivating in-vehicle experience that automakers and consumers want, while opening an endless array of new revenue-generating opportunities. With the right technology and solution partner, CSPs can put themselves in the driver’s seat with respect to growing their businesses and driving better returns on their 5G investment.

Click for more related content

Webinar: What's next in content delivery

Maximising streaming efficiency for 5G video growth (PDF)